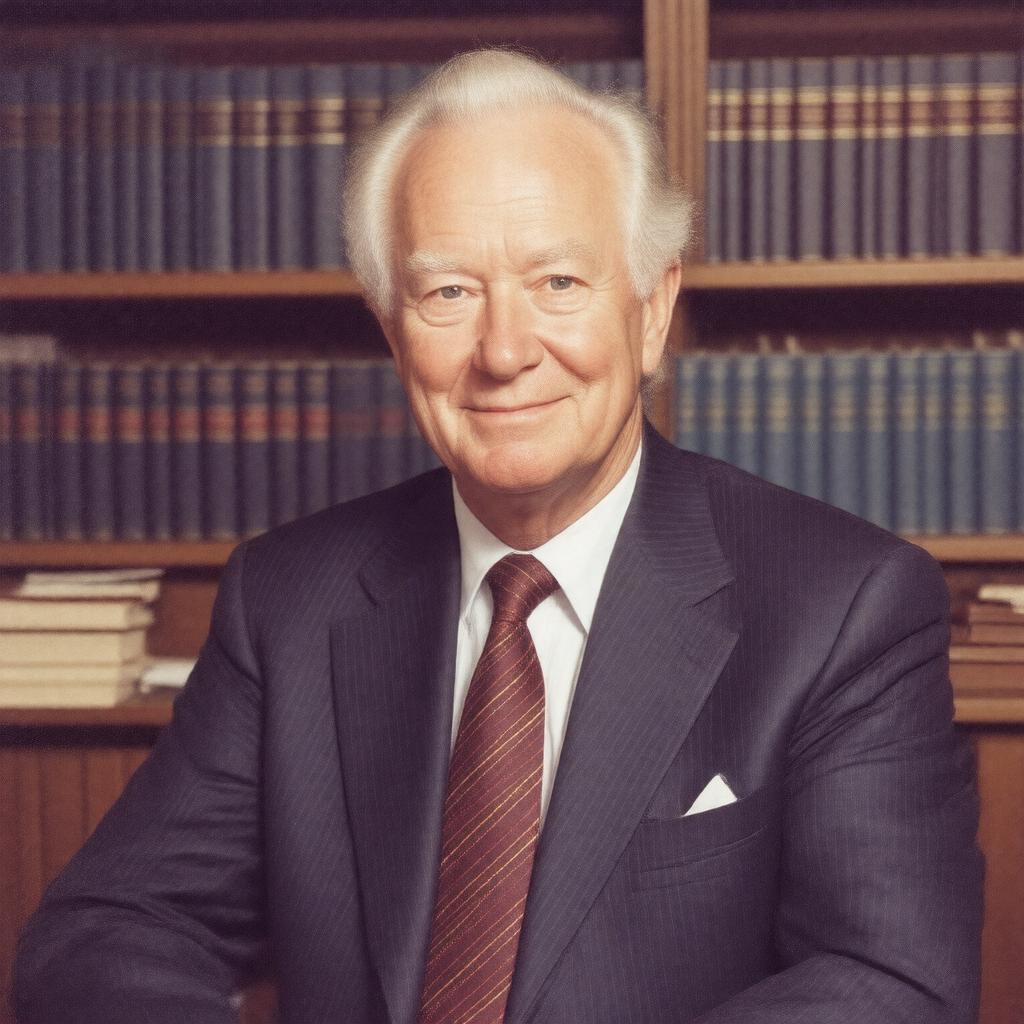

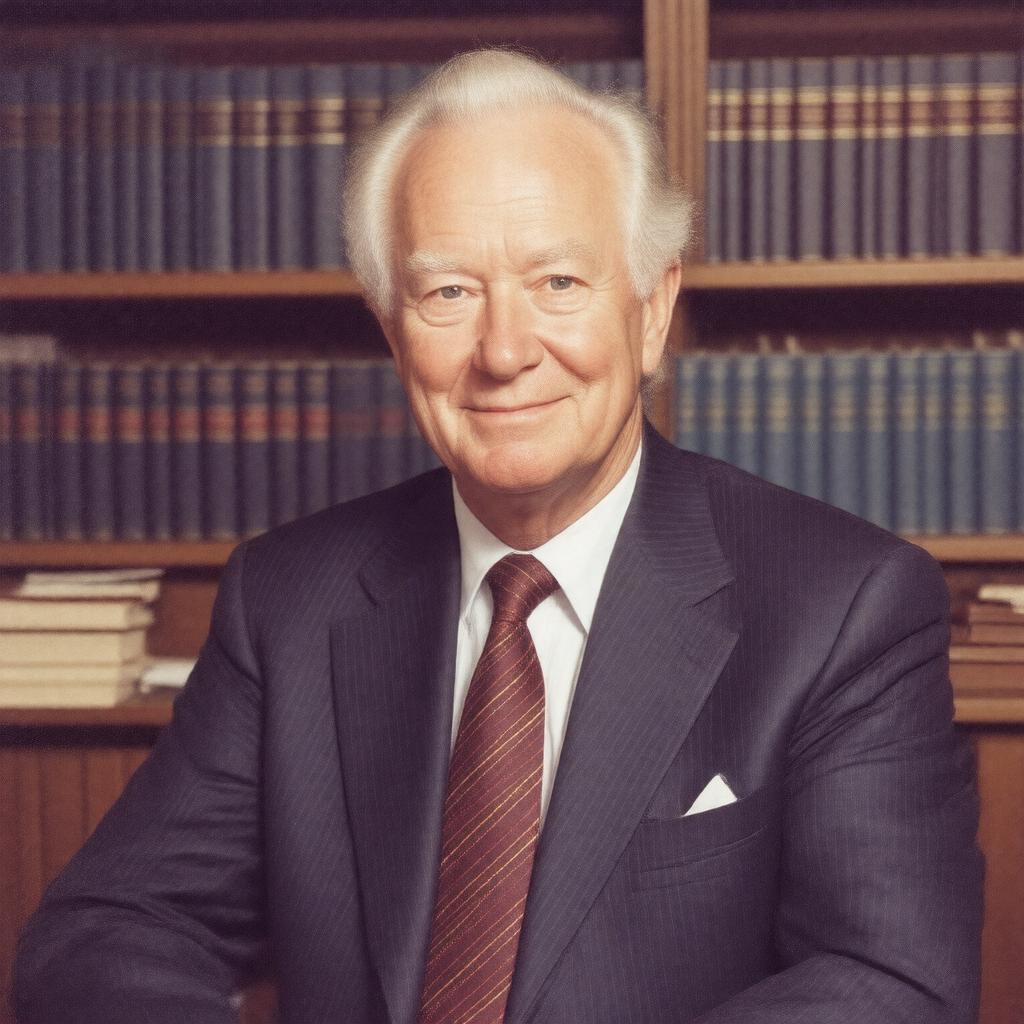

Prompt

"A formal portrait of Sir James Mirrlees, a British economist, sitting in a dignified pose with a slight smile, wearing a suit and tie, with a background that subtly suggests his academic and professional achievements, such as a bookshelf or a university setting; the style should be realistic and professional, conveying a sense of respect and authority."