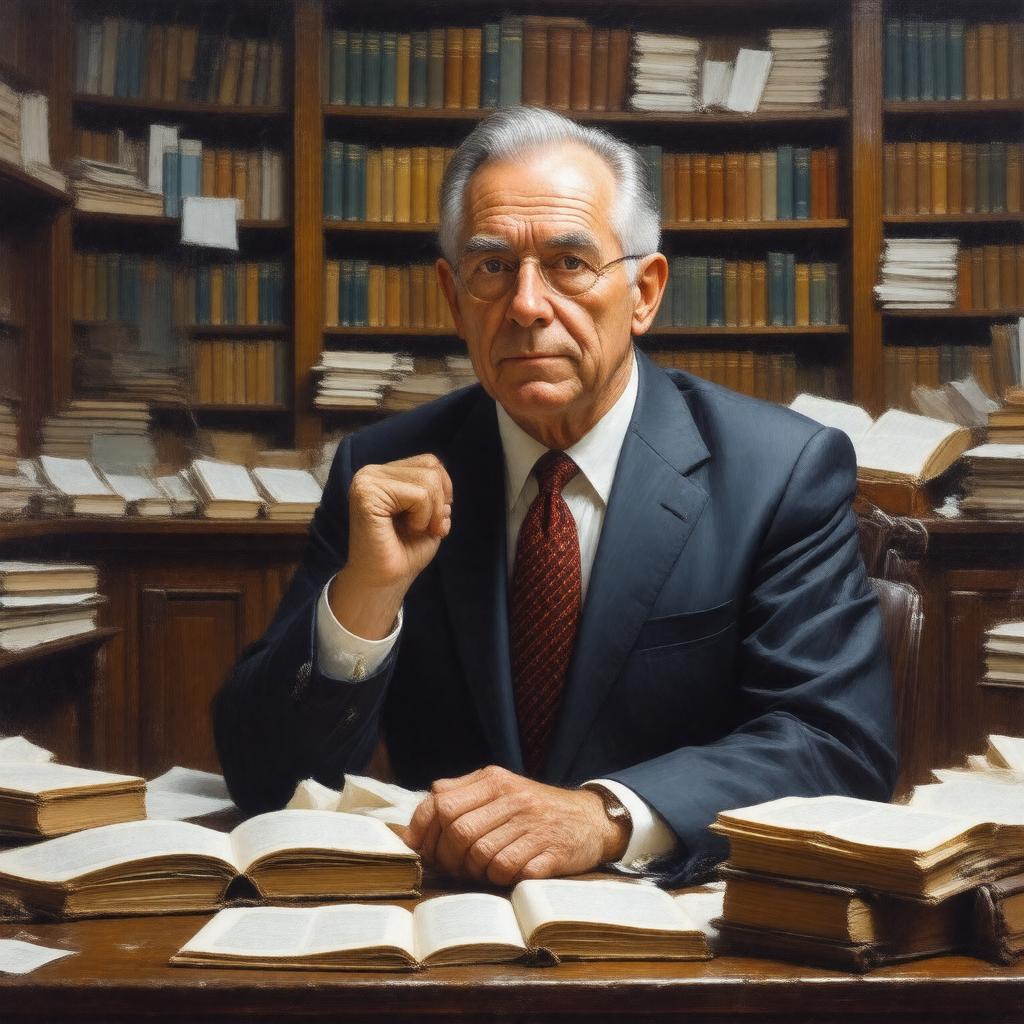

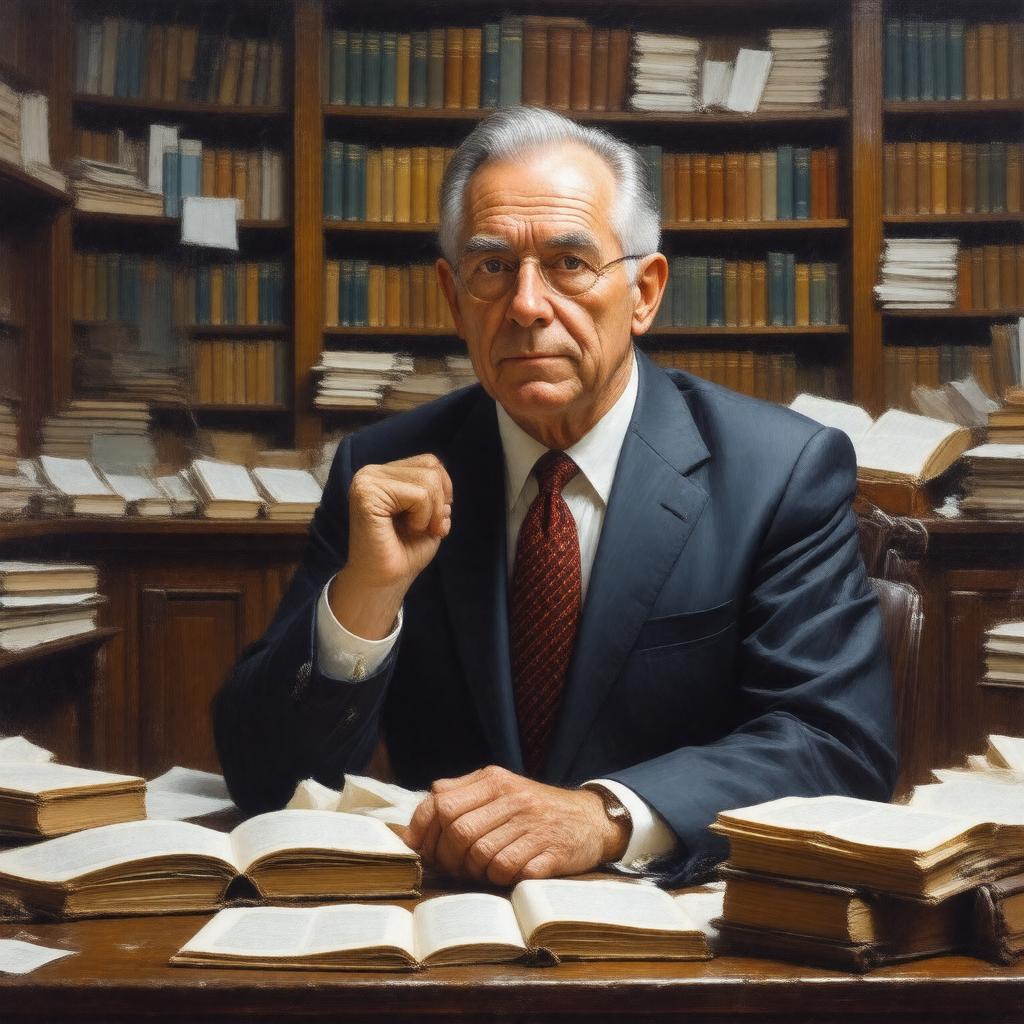

Prompt

Create a realistic image of Robert C. Merton, a renowned economist and professor, sitting in a library with books and papers scattered around him, with a thoughtful expression on his face, wearing a suit and tie, in a style that reflects his professional and intellectual persona, with a subtle background that hints at his connection to finance and economics.